🌐⛽️ Iran, Saudi Arabia, UAE… the world just changed dramatically. West has lost control over global oil prices and likely over capacity to engage in most economic sanctions.

The most anticipated Brics conference in history has just concluded and the results have been significant. Since the start of the war in Ukraine last year and the Western sanctions on Russia, developing countries have become increasingly vocal about forging their own path, and this latest conference showed a glimpse of what the future might hold.

The conference was centred around ending the reliance of developing countries on the US dollar. This move against the currency can also be traced back to sanctions: after the United States seized Russia’s currency reserves, other countries realised that their own holdings might be subject to “geopolitical risk”.

The most concrete move in this direction was an announcement this week by the head of the Shanghai-based New Development Bank, Dilma Rousseff. She said that the Brics bank would be increasing lending to its members but, unlike the IMF and the World Bank, that it would also be lending in local currencies, and would not attach the sort of conditionality that comes with loans from the aforementioned global lenders. Relatedly, Rousseff announced that the Brics bank was considering 15 new members.

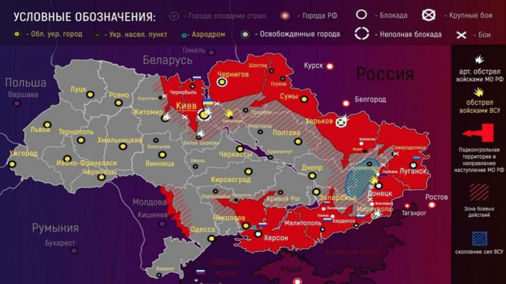

Towards the end of the conference, South African President Cyril Ramaphosa also announced that the Brics would invite six new members from January of next year: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and UAE. Since the war, 22 countries have joined the queue. If all these nations eventually join, Brics will go from making up 32% of global GDP to making up 45% — far more than the G7, which comprises just over 30%.

Strikingly, Iran’s addition will mean that it is no longer isolated from the world economy. Given that the country is the world’s eighth largest oil producer and possesses the third largest proven oil reserves, this is a substantial economic and geopolitical development.

Saudi Arabia and the UAE joining is likewise extremely significant. The United States used to rely on the Gulf monarchies, especially Saudi Arabia, to exert control over the oil price. With their accession to the Brics, it seems likely that America has lost any control it had over oil prices for the foreseeable future.

In the West these developments have been met with bemusement. There has been lots of trumpeting about weak Chinese growth numbers and a faltering Russian rouble, but both pale in comparison to half the global economy going its own way. There has been almost no discussion of Iran’s reemergence on the world stage, or the loss of control over global oil prices via the Gulf monarchies.

One constructive proposal is for Western countries to try to pull India out of the orbit of the Brics countries and integrate it into the G7 — relabelled the G8. The idea seems to rest on the fact that China and India are not friendly toward one another and have constant border disputes. But sadly, when looking at such economic arrangements, the numbers do not add up.

Looking at India’s top five trading partners, the United States is in the number one spot, followed by two Brics members and a further two will be incorporated next year: China, UAE, Saudi Arabia, and Russia. Total trade with the United States was around $118.2bn in 2022, but trade with the other four countries was around $274.6bn – more than double the amount.

Foreign policy strategists can focus all they like on border disputes and regional tension, but if history teaches us anything it is that trade and economic relations tend to be more important than either. We are going to have to find a way to live in this emerging world whether we like it or not, and the sooner we realise this the sooner we can discuss how to do it.